Crypto ATMs: A Gateway For Crime?

viral.buzzorbitnews

Aug 06, 2025 · 6 min read

Table of Contents

Crypto ATMs: A Gateway for Crime?

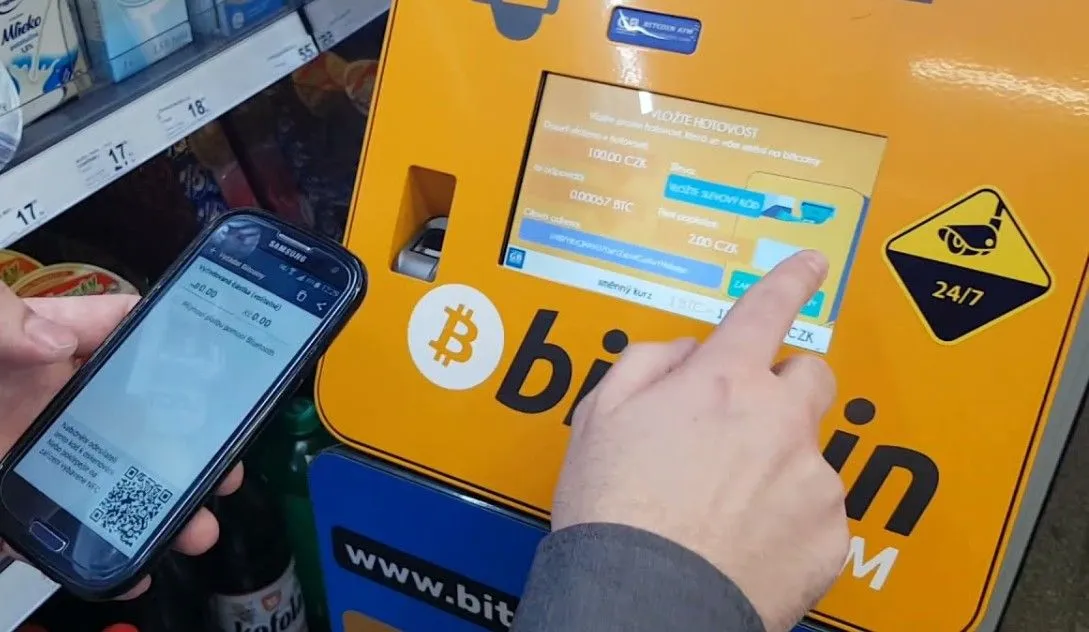

The rise of cryptocurrency has brought with it a new breed of financial access point: the cryptocurrency ATM (or crypto ATM). These machines allow users to buy and sell cryptocurrencies using fiat currency, offering a seemingly convenient alternative to online exchanges. However, this ease of access has raised significant concerns about the potential for these machines to be exploited for illicit activities, becoming a gateway for crime. This article delves into the multifaceted nature of crypto ATMs, examining their legitimate uses while exploring the substantial risks associated with their potential for money laundering, terrorist financing, and other criminal activities. We'll examine the regulatory landscape, technological vulnerabilities, and the ongoing debate surrounding their future. Understanding the complexities surrounding crypto ATMs is crucial for policymakers, law enforcement, and individuals alike, as their prevalence continues to grow.

How Crypto ATMs Work: A Step-by-Step Guide

Crypto ATMs operate similarly to traditional ATMs, but with a crucial difference: they deal in cryptocurrencies instead of fiat currencies. The process generally involves the following steps:

-

Location Identification: Users locate a nearby crypto ATM using online directories or mobile apps. The location of these ATMs varies widely, from busy shopping malls to less-regulated areas.

-

User Verification: Most crypto ATMs require some form of identification, ranging from simple phone verification to more rigorous KYC (Know Your Customer) procedures involving passport or driver's license scanning. However, the level of verification can differ significantly between machines, raising concerns about the potential for anonymity.

-

Transaction Selection: Users select whether they wish to buy or sell cryptocurrency. They specify the desired cryptocurrency (Bitcoin, Ethereum, Litecoin, etc.) and the amount they want to transact.

-

Payment: If buying cryptocurrency, users insert fiat currency (cash) into the machine. If selling, they provide their cryptocurrency wallet address to receive the equivalent fiat currency. Some machines accept debit/credit cards as well, though this adds another layer of potential vulnerability.

-

Transaction Confirmation: The transaction is processed, and the user receives a confirmation code or QR code. The cryptocurrency is then transferred to or from the user's wallet.

-

Receipt: The machine issues a receipt detailing the transaction, including the date, time, amount, and cryptocurrency involved. The level of detail provided on the receipt varies significantly.

Note: The specific steps and features may vary slightly depending on the specific crypto ATM manufacturer and operator.

The Scientific Context: Blockchain's Double-Edged Sword

The underlying technology powering crypto ATMs is blockchain, a decentralized, immutable ledger. While this technology offers transparency and security benefits in theory, its application in the context of crypto ATMs presents a complex picture. The inherent anonymity associated with some cryptocurrencies, combined with the varying levels of KYC implementation in crypto ATMs, creates a fertile ground for criminal activity. The pseudo-anonymity offered by some cryptocurrencies makes it difficult to trace the flow of funds, enabling money laundering and terrorist financing. Furthermore, the lack of consistent regulatory oversight across jurisdictions contributes to the problem. While blockchain itself is transparent, the entry and exit points—the crypto ATMs—can be easily exploited if insufficient regulations and security measures are in place.

The Dark Side: Criminal Exploitation of Crypto ATMs

The anonymity and ease of access provided by crypto ATMs create several avenues for criminal exploitation:

-

Money Laundering: Crypto ATMs can be used to convert illicit cash proceeds into cryptocurrency, effectively masking the origins of the funds. The subsequent transfer of cryptocurrency to different wallets and exchanges further obscures the money trail.

-

Terrorist Financing: Terrorist organizations can utilize crypto ATMs to anonymously raise funds and move money across borders, evading traditional financial monitoring systems.

-

Drug Trafficking: The illicit drug trade extensively uses cryptocurrency for transactions, and crypto ATMs serve as convenient points for converting cash obtained from drug sales into digital assets.

-

Tax Evasion: Crypto ATMs can facilitate tax evasion by providing a means to conceal income and avoid paying taxes on cryptocurrency transactions.

-

Ransomware Payments: Cryptocurrency is frequently used as a payment method for ransomware attacks, and crypto ATMs can provide a convenient and relatively anonymous way to obtain the necessary funds.

-

Darknet Market Transactions: Crypto ATMs can be exploited to facilitate transactions on darknet markets, where illicit goods and services are bought and sold.

Regulatory Challenges and Enforcement Difficulties

Regulating crypto ATMs presents numerous challenges for governments and law enforcement agencies:

-

Jurisdictional Issues: The decentralized nature of cryptocurrencies and the global reach of crypto ATM networks make it difficult to establish clear jurisdictional responsibilities.

-

Lack of Harmonized Regulations: The absence of internationally coordinated regulations creates a patchwork of rules and enforcement mechanisms, leaving gaps that criminals can exploit.

-

Technological Complexity: Understanding the technical aspects of blockchain and cryptocurrency transactions requires specialized expertise, posing challenges for law enforcement agencies trying to trace illicit activities.

-

Limited Tracking Capabilities: While blockchain offers transparency, tracking cryptocurrency transactions through multiple exchanges and wallets can be complex and time-consuming.

-

Anonymising Techniques: Criminals employ various techniques to enhance their anonymity when using crypto ATMs, such as using virtual private networks (VPNs) and mixing services to obfuscate their identities.

FAQ: Addressing Common Questions

Q1: Are all crypto ATMs used for illegal activities?

A1: No, many individuals use crypto ATMs for legitimate purposes, such as buying and selling cryptocurrency for investment or personal use. However, the potential for misuse remains a significant concern.

Q2: How can law enforcement track transactions made through crypto ATMs?

A2: Law enforcement agencies employ various techniques, including blockchain analysis, collaboration with crypto ATM operators, and monitoring of suspicious activities. However, tracing illicit transactions can be challenging due to the complexities involved.

Q3: What steps are being taken to regulate crypto ATMs?

A3: Various jurisdictions are implementing measures such as KYC requirements, transaction reporting, and stricter licensing procedures for crypto ATM operators. However, a global, harmonized approach is still lacking.

Q4: What are the risks associated with using crypto ATMs?

A4: Risks include scams, theft, and the potential for transactions to be traced back to the user, even if anonymity is intended. Users should always prioritize security and choose reputable crypto ATM operators.

Q5: What is the future of crypto ATMs?

A5: The future of crypto ATMs depends largely on the regulatory landscape and the ongoing efforts to mitigate the risks associated with their use. Increased regulation, improved security measures, and enhanced monitoring could help curb their use for illicit purposes.

Conclusion: A Balancing Act

Crypto ATMs offer a convenient gateway to the world of cryptocurrency, but their potential for criminal exploitation cannot be ignored. While they serve legitimate purposes for some users, the risks associated with money laundering, terrorist financing, and other illicit activities are substantial. The path forward requires a balanced approach: fostering innovation and legitimate use while implementing robust regulatory frameworks and security measures to minimize the potential for misuse. This necessitates international cooperation, technological advancements, and a collective effort to harness the benefits of cryptocurrency while mitigating its inherent risks. Further research into advanced monitoring techniques and the development of more secure and transparent crypto ATM systems is crucial. Stay informed about developments in this rapidly evolving field by reading our upcoming articles on cryptocurrency regulation and blockchain technology.

Latest Posts

Latest Posts

-

A We Will Continue To Update This Article As The Case Progresses

Aug 06, 2025

-

Bergsteigerin Stirbt Bei Traunstein Absturz

Aug 06, 2025

-

Q What Are The Legal Complexities Involved

Aug 06, 2025

-

Russ Sanders Runs For Prattville City Council

Aug 06, 2025

-

Babler Appoints New Key Officials In Sports Ministry

Aug 06, 2025

Related Post

Thank you for visiting our website which covers about Crypto ATMs: A Gateway For Crime? . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.