Crypto ATMs: Gateway For Criminal Activity?

viral.buzzorbitnews

Aug 05, 2025 · 5 min read

Table of Contents

Crypto ATMs: Gateway for Criminal Activity?

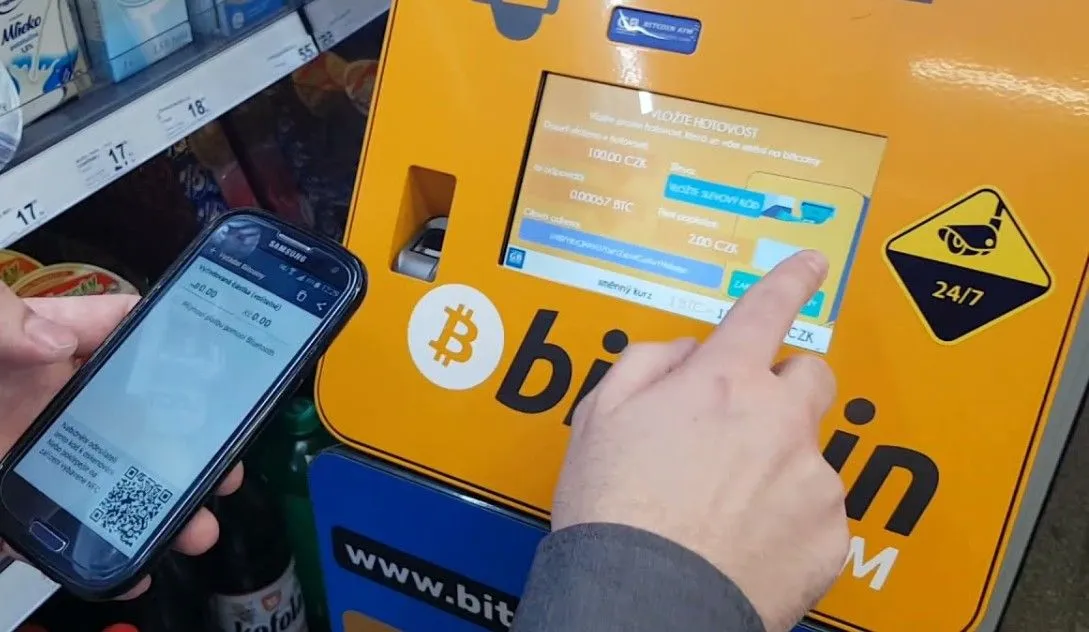

Crypto ATMs, also known as Bitcoin ATMs or cryptocurrency ATMs, are kiosks that allow users to buy and sell cryptocurrencies using cash or debit/credit cards. While offering a convenient alternative to traditional cryptocurrency exchanges, these machines have also raised serious concerns about their potential use in facilitating illicit activities. This article will delve into the various ways crypto ATMs can be exploited for criminal purposes, examining the regulatory challenges and exploring potential solutions to mitigate these risks. Understanding the vulnerabilities of these machines is crucial for both law enforcement agencies and users to navigate the increasingly complex landscape of cryptocurrency transactions. The anonymity offered by cryptocurrencies, coupled with the often-lax regulatory oversight surrounding crypto ATMs, creates a fertile ground for money laundering, terrorist financing, and other forms of financial crime.

The Dark Side of Convenience: How Crypto ATMs Facilitate Crime

Crypto ATMs, despite their potential benefits, present several significant vulnerabilities that criminals can exploit:

-

Anonymity and Lack of KYC/AML Compliance: Unlike traditional banks and regulated exchanges, many crypto ATMs operate with minimal Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. This allows users to conduct transactions with a high degree of anonymity, making it difficult to trace the origin and destination of funds. Criminals can easily use these machines to launder money derived from illegal activities, obscuring the flow of funds and making it challenging for law enforcement to investigate.

-

Limited Transaction Monitoring: The decentralized nature of cryptocurrencies, combined with the often-decentralized operation of crypto ATM networks, makes comprehensive transaction monitoring extremely difficult. While some operators implement basic monitoring systems, many lack the sophisticated tools and resources necessary to detect and prevent suspicious activities effectively. This lack of oversight allows criminals to exploit loopholes and avoid detection.

-

Ease of Access and Geographic Dispersion: Crypto ATMs are increasingly prevalent globally, often located in easily accessible public places. This widespread accessibility makes them attractive to criminals seeking to quickly convert cash into cryptocurrencies, bypassing traditional banking systems. Their geographic dispersion further complicates law enforcement efforts to track and monitor transactions.

-

Use in Darknet Markets and Ransomware Payments: Crypto ATMs can facilitate transactions with darknet marketplaces, where illegal goods and services are traded anonymously. The untraceability of cryptocurrency transactions makes it an ideal payment method for these markets. Similarly, ransomware attackers often demand payment in cryptocurrencies, and crypto ATMs provide a convenient way for victims to fulfill these demands.

-

Tax Evasion: The inherent anonymity associated with some crypto ATM transactions enables users to evade taxes by concealing income and avoiding reporting requirements. This is particularly concerning given the volatile nature of cryptocurrencies, creating opportunities for tax fraud and manipulation.

-

Funding of Terrorism: The decentralized and pseudonymous nature of cryptocurrencies, coupled with the anonymity offered by some crypto ATMs, make them an attractive tool for terrorist organizations to raise and move funds without detection.

The Scientific Context: Blockchain Analysis and its Limitations

The underlying technology of cryptocurrencies, blockchain, is designed to be transparent and immutable. Each transaction is recorded on a public ledger, making it theoretically traceable. However, in practice, tracing cryptocurrency transactions through the blockchain can be incredibly complex and resource-intensive.

-

Mixing and Tumbling Services: Criminals often use “mixing” or “tumbling” services to obscure the origin of their funds by combining them with other transactions, making it difficult to trace the money back to its source. These services further complicate the analysis of blockchain data, even with advanced analytical tools.

-

Privacy Coins: Some cryptocurrencies, known as “privacy coins,” are designed to enhance anonymity, making them even more challenging to track. These coins use techniques like ring signatures and zero-knowledge proofs to mask transaction details, significantly hindering law enforcement investigations.

-

Scalability and Data Volume: The sheer volume of transactions on the blockchain can overwhelm analytical tools, making it difficult to process and analyze the data efficiently. This complexity is compounded by the need for skilled analysts and advanced software to decipher the intricate web of transactions.

Frequently Asked Questions (FAQs)

Q1: Are all Crypto ATMs used for illegal activities?

A1: No, the vast majority of crypto ATM transactions are likely legitimate. However, the potential for misuse is significant, and the lack of robust regulation and monitoring creates opportunities for criminal activity.

Q2: What regulations are in place to prevent criminal use of Crypto ATMs?

A2: Regulations vary significantly across jurisdictions. Some countries have implemented stricter KYC/AML requirements for crypto ATM operators, while others have minimal or no regulations. The fragmented nature of the regulatory landscape makes it challenging to effectively combat the misuse of these machines.

Q3: How can law enforcement agencies combat the use of Crypto ATMs for criminal purposes?

A3: Law enforcement needs a multi-faceted approach, including enhanced collaboration between agencies, improved data sharing, investment in blockchain analysis tools, and stricter regulations on KYC/AML compliance for crypto ATM operators. International cooperation is crucial given the global nature of cryptocurrency transactions.

Q4: What role do crypto ATM operators play in preventing criminal activity?

A4: Responsible operators should implement robust KYC/AML procedures, actively monitor transactions for suspicious activity, and cooperate with law enforcement investigations. They also have a responsibility to educate their users about the potential risks associated with cryptocurrency transactions and to encourage responsible use of their services.

Q5: What can individuals do to protect themselves from becoming involved in illegal activities through Crypto ATMs?

A5: Individuals should only use reputable crypto ATMs that have robust KYC/AML procedures in place. They should be aware of the potential risks associated with cryptocurrency transactions and avoid using these machines for illegal activities. If suspicious activity is witnessed, it should be reported to the appropriate authorities.

Conclusion: A Call for Enhanced Regulation and Responsible Use

Crypto ATMs offer a convenient gateway to the world of cryptocurrencies, but their potential for misuse in facilitating criminal activities cannot be ignored. The lack of robust regulation and oversight, coupled with the anonymity afforded by cryptocurrencies, creates a breeding ground for money laundering, terrorist financing, and other forms of financial crime. To mitigate these risks, a multi-pronged approach is required, encompassing stricter KYC/AML regulations, enhanced monitoring of transactions, investment in blockchain analysis tools, and increased international cooperation. Responsible use by individuals, combined with ethical practices by crypto ATM operators, is crucial in ensuring that these machines do not become primary tools for criminal enterprises. For further insights into the regulatory landscape of cryptocurrencies and their associated risks, explore our article on "Navigating the Regulatory Maze of Cryptocurrencies."

Latest Posts

Latest Posts

-

Mel C S Relationship With Her Current Boyfriend Has Been Relatively Private With Details Shared Selectively Through Interviews And Social Media This Approach Allows Her To Maintain A Level Of Personal Space While Still Connecting With Her Fans Lets Examine What We Know

Aug 06, 2025

-

Assisted Suicide Also Known As Physician Assisted Suicide Pas Or Assisted Dying Involves A Physician Providing A Patient With The Means To End Their Life The Ethical And Legal Implications Are Intensely Debated Considering Factors Like Patient Autonomy The Potential For Abuse And The Role Of Healthcare Professionals While Often Associated With Terminal Illnesses The Specific Circumstances Of Each Case Greatly Influence The Legal And Ethical Assessment

Aug 06, 2025

-

Past Relationships Analyzing Her Previous Relationships And Statements Provides Context For Understanding Her Present Views While Specifics Arent Widely Publicized Understanding Her Past Helps Illustrate Her Evolving Perspective On Love And Commitment

Aug 06, 2025

-

Lindsay Lohans Fearless Youth A Look Back

Aug 06, 2025

-

Bablers Sports Ministry Restructure Key Changes

Aug 06, 2025

Related Post

Thank you for visiting our website which covers about Crypto ATMs: Gateway For Criminal Activity? . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.