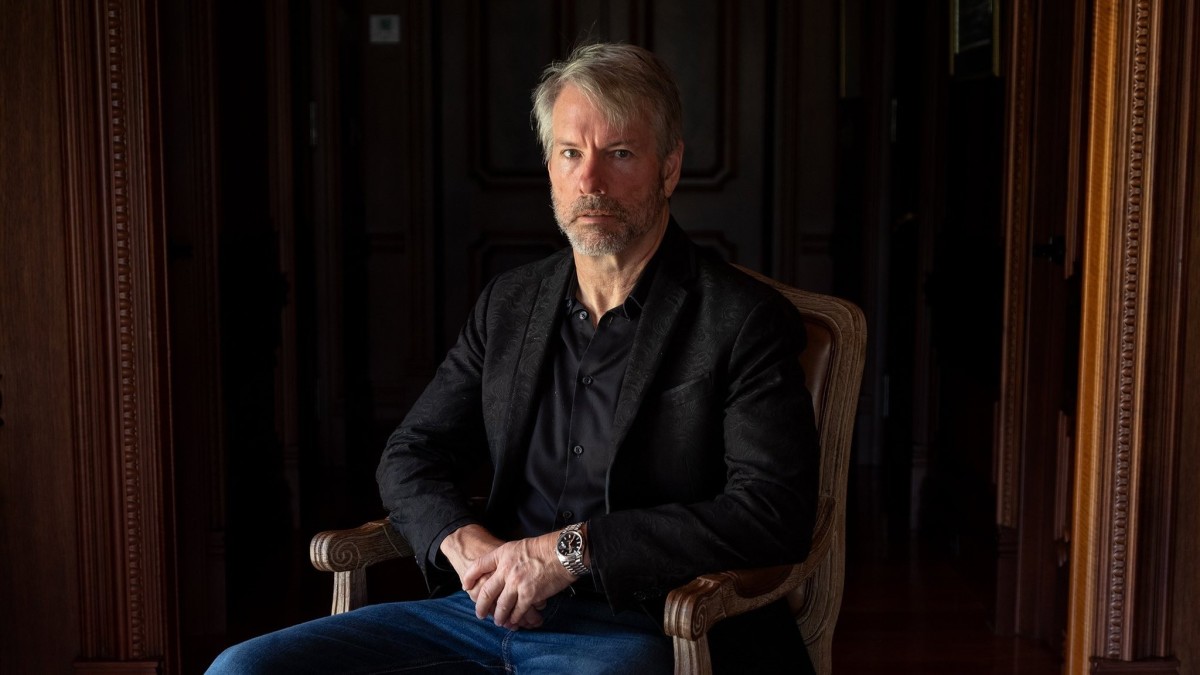

Michael Saylor's Massive Bitcoin Buy: Market Dip Analysis

viral.buzzorbitnews

Jul 31, 2025 · 6 min read

Table of Contents

Michael Saylor's Massive Bitcoin Buy: Market Dip Analysis

MicroStrategy, under the leadership of its CEO Michael Saylor, has become synonymous with aggressive Bitcoin accumulation. Saylor's unwavering belief in Bitcoin as a superior store of value has led to the company making headlines repeatedly for its substantial purchases, even during market downturns. This article delves deep into the strategy behind these buys, specifically focusing on acquisitions made during market dips and analyzing their implications for both MicroStrategy and the broader Bitcoin market. Understanding Saylor's approach offers valuable insights for both seasoned investors and newcomers considering Bitcoin as part of their portfolio. We’ll explore the reasoning, the potential risks, and the possible long-term effects of this bold investment strategy, shedding light on the ongoing narrative of Bitcoin’s evolution and its place in the evolving financial landscape. The significance of Saylor's actions cannot be overstated; his consistent purchases inject considerable confidence into the market and influence the narrative surrounding Bitcoin's future.

Understanding Saylor's Bitcoin Strategy

Saylor's Bitcoin strategy is rooted in a fundamental belief in Bitcoin's inherent value proposition. He views Bitcoin not as a volatile speculative asset, but as a superior form of digital gold – a hard asset with a finite supply, resistant to inflation, and possessing the potential to appreciate significantly over the long term. This perspective underpins his decision to allocate a substantial portion of MicroStrategy's treasury reserves to Bitcoin, often during periods of market volatility. His acquisitions aren't driven by short-term price fluctuations; instead, he focuses on accumulating Bitcoin strategically over the long haul, capitalizing on dips to increase the company's holdings at a lower average cost.

This approach differs significantly from traditional corporate treasury management strategies. While most companies prioritize liquidity and short-term gains, Saylor has prioritized long-term value preservation and appreciation, accepting the inherent risks associated with Bitcoin's volatility. His strategy is fundamentally a bet on Bitcoin’s future dominance as a store of value and a hedge against inflation. He believes that the long-term appreciation of Bitcoin will far outweigh any short-term losses incurred during market corrections.

Analyzing Bitcoin Buys During Market Dips

Saylor's most significant Bitcoin purchases have often coincided with market dips, periods characterized by significant price drops. This counter-cyclical buying strategy is a core component of his overall approach. Several factors contribute to his willingness to buy during these periods:

-

Reduced Price: Market dips offer the opportunity to acquire Bitcoin at a lower price, increasing the potential for future returns. This is a classic value investing strategy applied to the cryptocurrency market.

-

Accumulation Opportunity: Dips represent a chance to substantially increase Bitcoin holdings, thereby lowering the average purchase price over time. This "dollar-cost averaging" approach mitigates the impact of short-term price fluctuations.

-

Market Sentiment: Saylor often uses periods of negative market sentiment to signal confidence and potentially influence investor perception. His significant purchases can act as a counterbalance to bearish sentiment, potentially encouraging other investors to follow suit.

-

Long-Term Vision: Saylor’s conviction in Bitcoin’s long-term value remains unshaken by short-term price volatility. Market dips are viewed as temporary setbacks, not indicators of fundamental weakness.

-

Risk Tolerance: MicroStrategy's decision to allocate a significant portion of its treasury to Bitcoin demonstrates a high risk tolerance. This willingness to embrace volatility is central to Saylor's strategy.

It is important to note that while Saylor's approach has yielded significant returns during Bitcoin's bull markets, it also exposes MicroStrategy to considerable risk during prolonged bear markets. The company's financial performance is intrinsically linked to the price of Bitcoin, making it susceptible to large losses if the price significantly and persistently declines.

Case Studies of Significant Buys During Market Dips

Several specific instances showcase Saylor's strategic buying during market downturns:

-

2020-2021 Bull Run: MicroStrategy started its Bitcoin accumulation early, making purchases throughout 2020 and into 2021. These purchases strategically capitalized on market dips, significantly increasing the company's holdings and benefitting from the subsequent bull run.

-

2022 Bear Market: The 2022 bear market saw significant drops in Bitcoin's price, presenting an opportunity for MicroStrategy to further accumulate. During this time, MicroStrategy continued purchasing, taking advantage of depressed prices.

Each of these instances highlights Saylor’s commitment to his strategy, even amidst market uncertainty and criticism. His continued buying during dips demonstrates a resolute belief in the long-term value proposition of Bitcoin.

The Scientific Context: Bitcoin's Scarcity and Network Effects

Saylor's strategy is grounded in a sound understanding of Bitcoin's fundamental properties. From a scientific perspective, two crucial factors underpin his approach:

-

Scarcity: Bitcoin's maximum supply of 21 million coins ensures its scarcity. This scarcity, combined with increasing demand, drives potential price appreciation over time, mirroring the behavior of other scarce assets like gold. This aligns with economic principles governing supply and demand.

-

Network Effects: Bitcoin's value is partly derived from network effects. As more people and institutions adopt Bitcoin, its utility and value increase. This network effect creates a positive feedback loop, potentially leading to exponential growth in its value. This principle is well-documented in other technological platforms that benefit from network effects.

Frequently Asked Questions (FAQs)

Q1: Is Saylor's strategy risky?

A1: Yes, Saylor's strategy is inherently risky. MicroStrategy's financial performance is heavily dependent on Bitcoin's price. Prolonged bear markets could significantly impact the company's financial health.

Q2: Could Saylor's strategy backfire?

A2: There is a possibility that Saylor's strategy could backfire if Bitcoin's price fails to appreciate significantly in the long term, or if a competing cryptocurrency surpasses Bitcoin in market dominance. Such scenarios could lead to substantial losses for MicroStrategy.

Q3: What are the potential benefits of Saylor's strategy?

A3: If Bitcoin's price appreciates as Saylor anticipates, MicroStrategy could realize substantial gains, potentially exceeding the returns from traditional investment strategies. Moreover, his approach has increased awareness and adoption of Bitcoin.

Q4: Is Saylor's strategy replicable for individual investors?

A4: While individual investors can adopt similar principles, it's crucial to assess their risk tolerance and financial situation before making significant investments in Bitcoin. Saylor's strategy is suitable for those with a high risk tolerance and long-term investment horizon.

Q5: What is the impact of Saylor's actions on the Bitcoin market?

A5: Saylor's large-scale purchases have a significant impact on market sentiment. His consistent buying, particularly during dips, can inject confidence and potentially attract other institutional investors, influencing Bitcoin's price and overall market dynamics.

Conclusion and Call to Action

Michael Saylor's aggressive Bitcoin accumulation strategy, particularly his counter-cyclical buying during market dips, is a fascinating case study in long-term investment in the cryptocurrency space. While risky, his approach reflects a fundamental belief in Bitcoin's long-term value proposition and leverages the principles of scarcity and network effects. Whether this strategy ultimately proves successful remains to be seen, but it has undoubtedly had a significant impact on the Bitcoin market and the wider narrative surrounding its future. To stay updated on the latest developments in the Bitcoin market and other cryptocurrencies, continue reading our blog and subscribe to our newsletter! Explore our other articles on Bitcoin investment strategies and market analysis for a comprehensive understanding of this evolving space.

Latest Posts

Latest Posts

-

Zweitliga Teams Face Tough Season Openers

Aug 01, 2025

-

Week End Aout 1 4 Perturbations Autoroutieres

Aug 01, 2025

-

Warnstufe Rot Unwetterwarnung Wo Droht Gefahr

Aug 01, 2025

-

Benko Empires Stueblergut Estate For Sale

Aug 01, 2025

-

Bretelle Fermee A10 A15 Prevoir Congestion

Aug 01, 2025

Related Post

Thank you for visiting our website which covers about Michael Saylor's Massive Bitcoin Buy: Market Dip Analysis . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.